Enterprise-Grade Earn Products

As integrated by

Coinbase

Kraken

Gemini

Ledger

Crypto.com

Binance

Trust Wallet

Powered by

Morpho

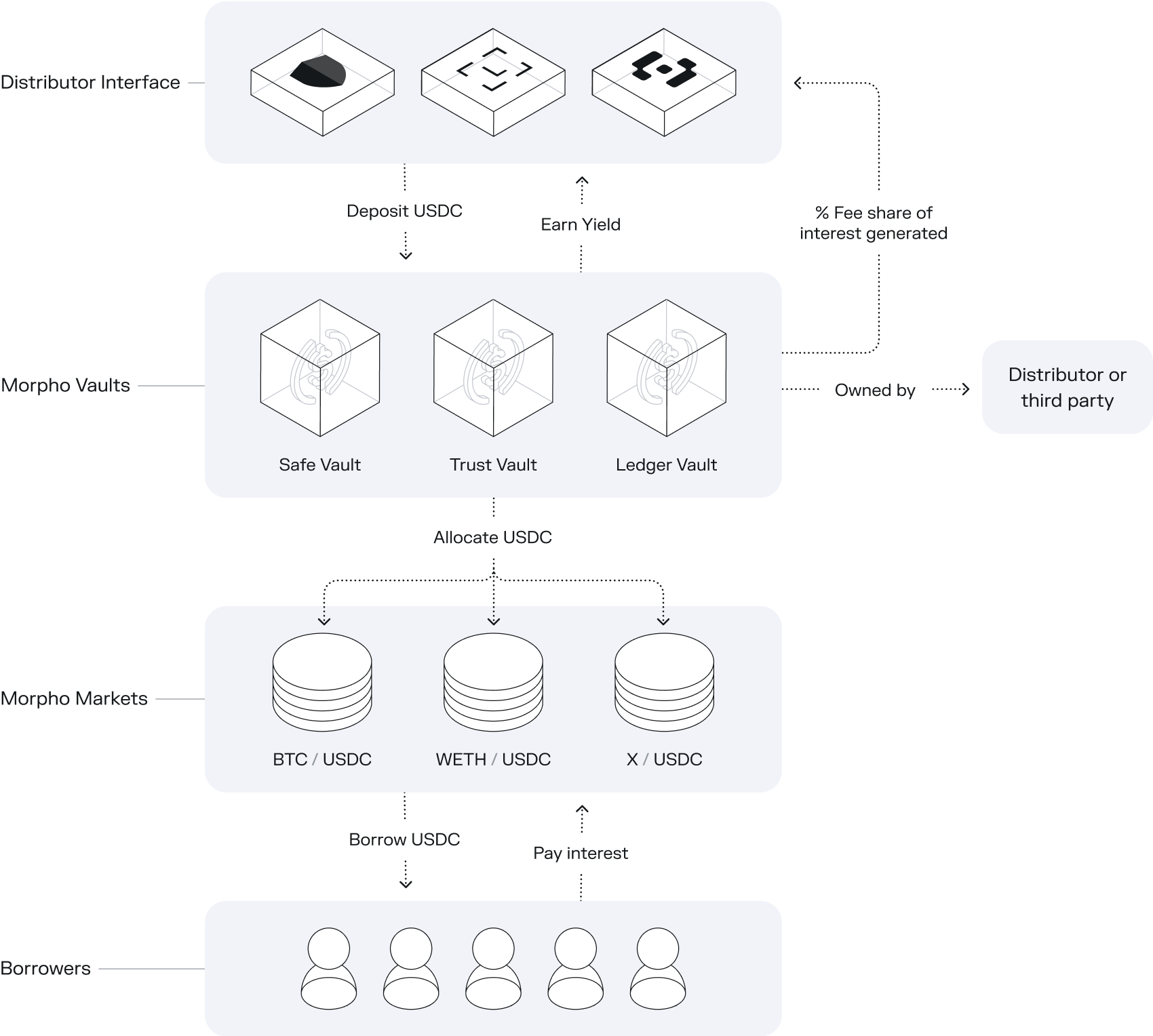

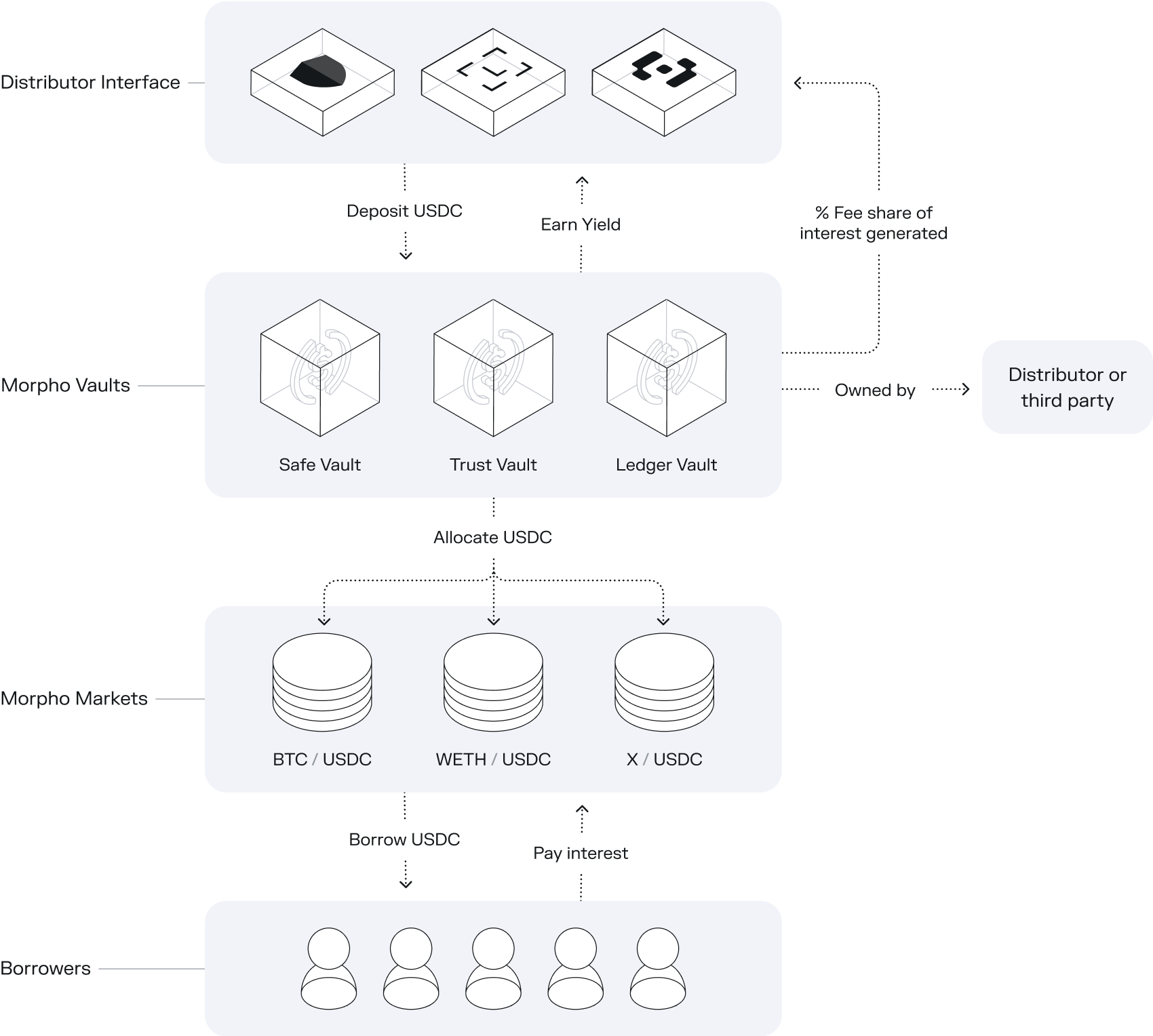

Deliver the best-risk adjusted yields to your users.

Earn products powered by Morpho give users access to the best onchain yield opportunities without the complexities associated with DeFi.

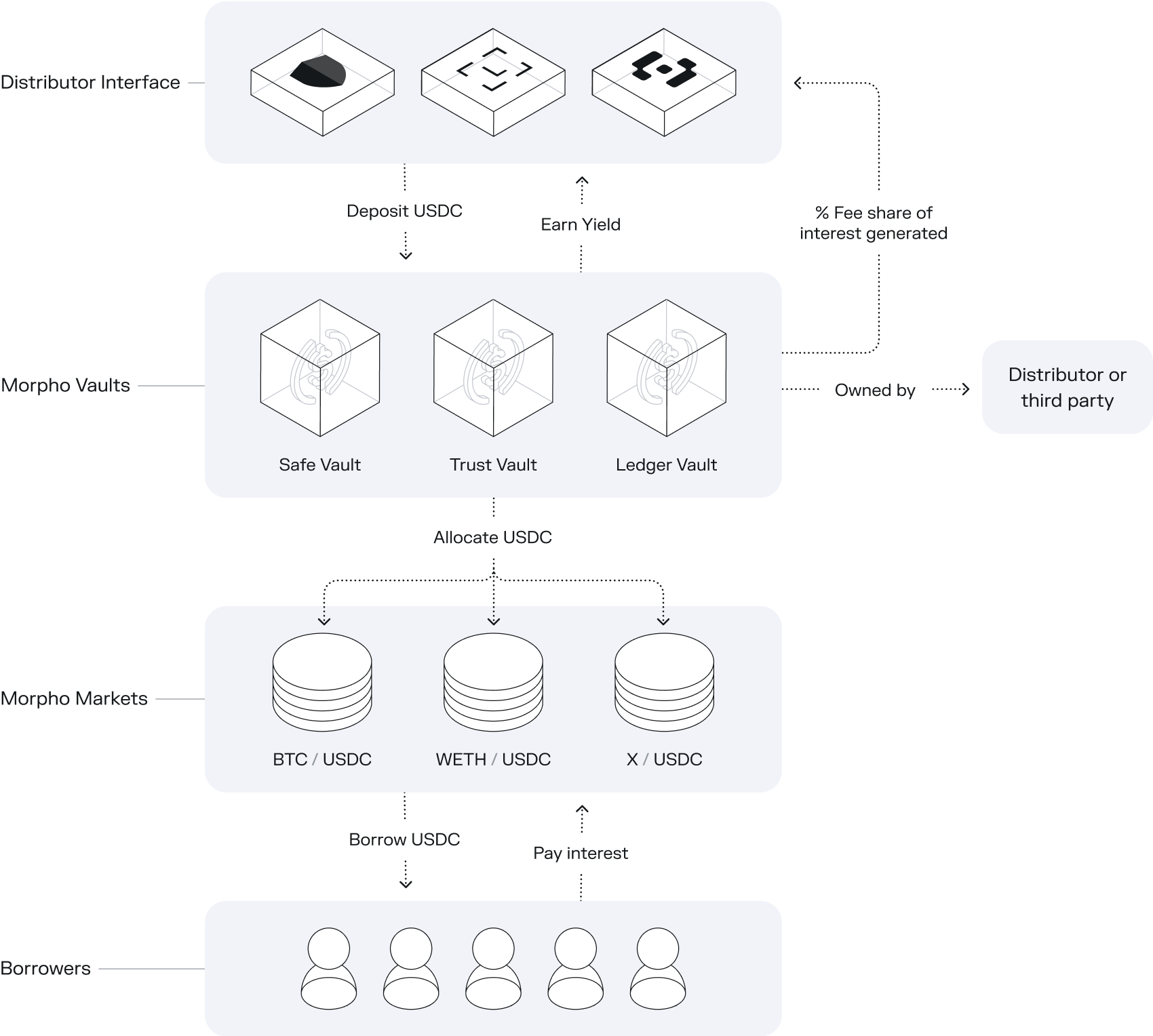

By integrating Morpho, distributors can abstract away blockchain complexities such as wallets, gas fees, and network selection, enabling users to easily earn yield on any asset—all within the existing application.

Users have diverse risk tolerances so Morpho offers multiple vault options with distinct risk profiles, allowing distributor to select and provide appropriately tailored solutions for different users.

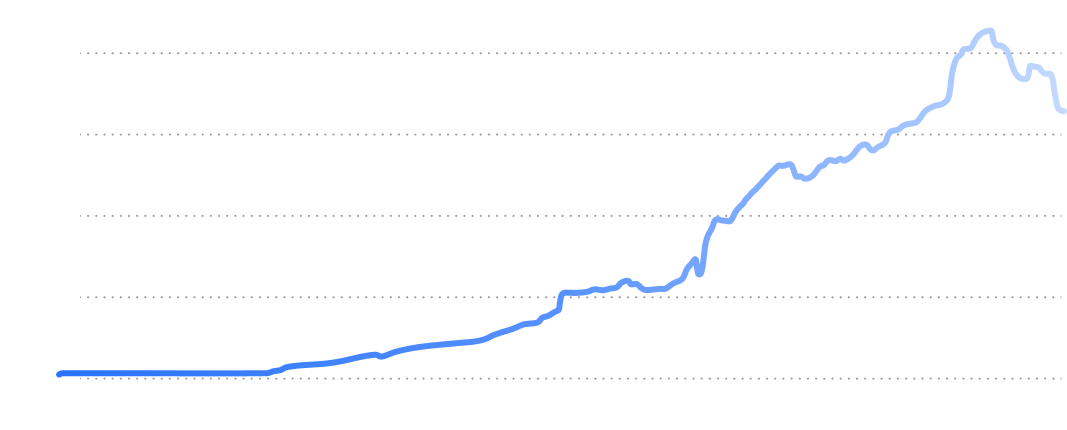

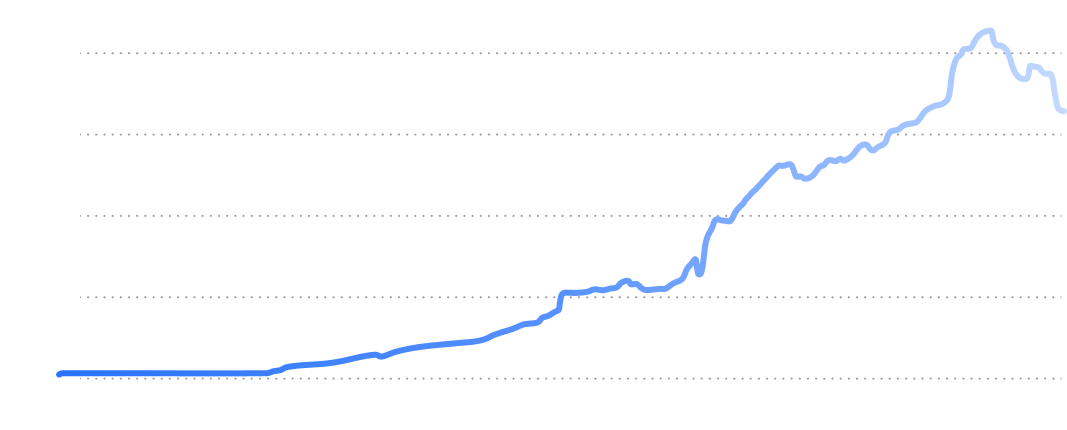

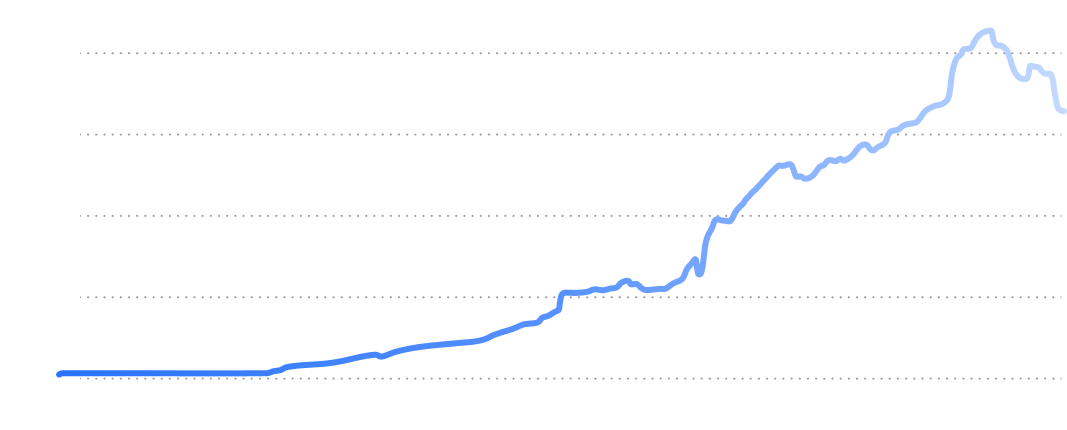

Earn Deposits

Coinbase

USDC is used an example, but earn products can support any loan asset.

USDC is used an example, but earn products can support any loan asset.

Your choice of integration

Custom Integration

Own the entire user journey by integrating with Morpho directly with white glove support from the Morpho integration team.

Powered by Morpho

White label

Morpho Earn

By

Enterprise-grade integration and monetization toolkit, including customizable compliance rules.

Embeddable Widget

Native API

Revenue Model For Distributors

Integrate an Existing Vault

Fee-sharing agreement

with the curator

Deploy & Own a Vault

Set a performance fee based

on interest generated

Custom implementations with end-to-end support

Tailored Risk

Offer curated vaults from conservative to aggressive for different users.

Reward Management

Bespoke rewards management to attract and retain users.

Compliance

Configurable to fit within existing compliance frameworks

Revenue Share

Earn a share of performance fees from capital you direct to vaults.

Everything you need from your yield infrastructure

Sustainable yield

Highly competitive rates driven by global borrowing demand.

Customizable

Use existing vaults or deploy new vaults with bespoke risk

profiles and compliance.

Noncustodial

Users maintain complete ownership of their assets and positions.

Trust through transparency

All yields, allocations, risks, and fund flows are verifiable onchain.

Enterprise-Grade Earn Products

As integrated by

Coinbase

Kraken

Gemini

Ledger

Crypto.com

Binance

Trust Wallet

Powered by

Morpho

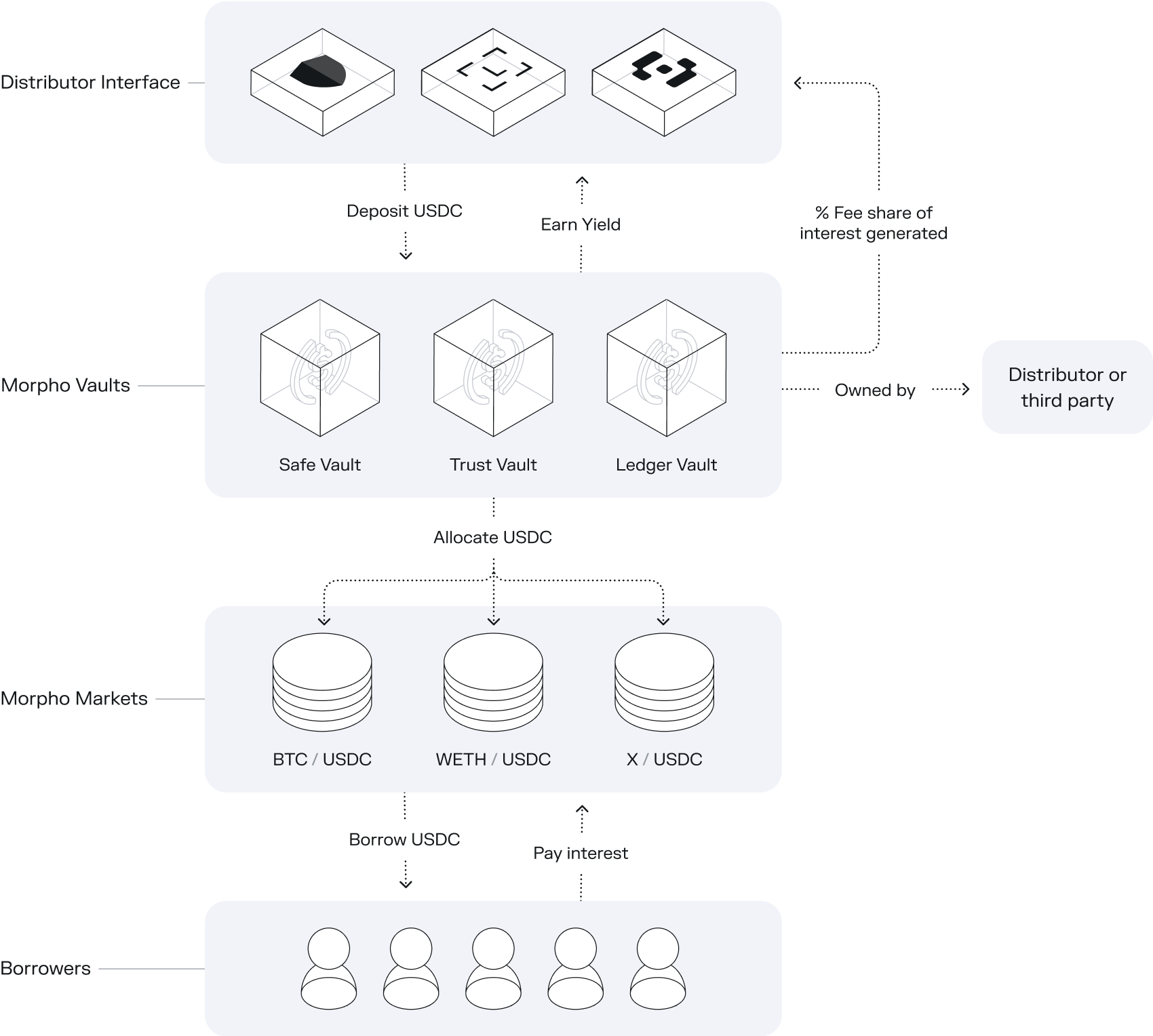

Deliver the best-risk adjusted yields to your users.

Earn products powered by Morpho give users access to the best onchain yield opportunities without the complexities associated with DeFi.

By integrating Morpho, distributors can abstract away blockchain complexities such as wallets, gas fees, and network selection, enabling users to easily earn yield on any asset—all within the existing application.

Users have diverse risk tolerances so Morpho offers multiple vault options with distinct risk profiles, allowing distributor to select and provide appropriately tailored solutions for different users.

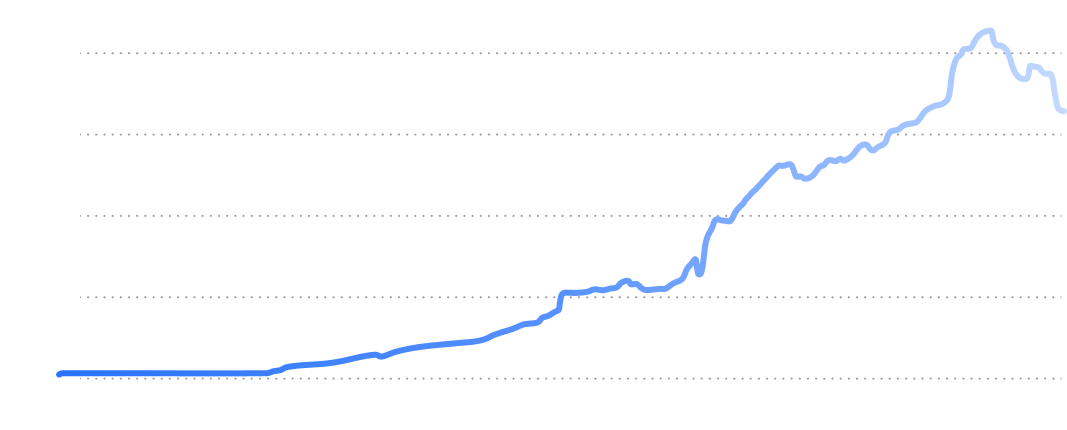

Earn Deposits

Coinbase

USDC is used an example, but earn products can support any loan asset.

Your choice of integration

Custom Integration

Own the entire user journey by integrating with Morpho directly with white glove support from the Morpho integration team.

Powered by Morpho

White label

Morpho Earn

By

Enterprise-grade integration and monetization toolkit, including customizable compliance rules.

Embeddable Widget

Native API

Revenue Model For Distributors

Integrate an Existing Vault

Fee-sharing agreement

with the curator

Deploy & Own a Vault

Set a performance fee based

on interest generated

Custom implementations with end-to-end support

Tailored Risk

Offer curated vaults from conservative to aggressive for different users.

Reward Management

Bespoke rewards management to attract and retain users.

Compliance

Configurable to fit within existing compliance frameworks

Revenue Share

Earn a share of performance fees from capital you direct to vaults.

Everything you need from your yield infrastructure

Sustainable yield

Highly competitive rates driven by global borrowing demand.

Customizable

Use existing vaults or deploy new vaults with bespoke risk profiles and compliance.

Noncustodial

Users maintain complete ownership of their assets and positions.

Trust through transparency

All yields, allocations, risks, and fund flows are verifiable onchain.

Enterprise-Grade Earn Products

As integrated by

Coinbase

Kraken

Gemini

Ledger

Crypto.com

Binance

Trust Wallet

Powered by

Morpho

Deliver the best-risk adjusted yields to your users.

Earn products powered by Morpho give users access to the best onchain yield opportunities without the complexities associated with DeFi.

By integrating Morpho, distributors can abstract away blockchain complexities such as wallets, gas fees, and network selection, enabling users to easily earn yield on any asset—all within the existing application.

Users have diverse risk tolerances so Morpho offers multiple vault options with distinct risk profiles, allowing distributor to select and provide appropriately tailored solutions for different users.

Earn Deposits

Coinbase

USDC is used an example, but earn products can support any loan asset.

Your choice of integration

Custom Integration

Own the entire user journey by integrating with Morpho directly with white glove support from the Morpho integration team.

Powered by Morpho

White label

Morpho Earn

By

Enterprise-grade integration and monetization toolkit, including customizable compliance rules.

Embeddable Widget

Native API

Revenue Model For Distributors

Integrate an Existing Vault

Fee-sharing agreement

with the curator

Deploy & Own a Vault

Set a performance fee based

on interest generated

Custom implementations with end-to-end support

Tailored Risk

Offer curated vaults from conservative to aggressive for different users.

Reward Management

Bespoke rewards management to attract and retain users.

Compliance

Configurable to fit within existing compliance frameworks

Revenue Share

Earn a share of performance fees from capital you direct to vaults.

Everything you need from your yield infrastructure

Sustainable yield

Highly competitive rates driven by global borrowing demand.

Customizable

Use existing vaults or deploy new vaults with bespoke risk profiles and compliance.

Noncustodial

Users maintain complete ownership of their assets and positions.

Trust through transparency

All yields, allocations, risks, and fund flows are verifiable onchain.

Enterprise-Grade Earn Products

As integrated by

Coinbase

Kraken

Gemini

Ledger

Crypto.com

Binance

Trust Wallet

Powered by

Morpho

Deliver the best-risk adjusted yields to your users.

Earn products powered by Morpho give users access to the best onchain yield opportunities without the complexities associated with DeFi.

By integrating Morpho, distributors can abstract away blockchain complexities such as wallets, gas fees, and network selection, enabling users to easily earn yield on any asset—all within the existing application.

Users have diverse risk tolerances so Morpho offers multiple vault options with distinct risk profiles, allowing distributor to select and provide appropriately tailored solutions for different users.

Earn Deposits

Coinbase

USDC is used an example, but earn products can support any loan asset.

Your choice of integration

Custom Integration

Own the entire user journey by integrating with Morpho directly with white glove support from the Morpho integration team.

Powered by Morpho

White label

Morpho Earn

By

Enterprise-grade integration and monetization toolkit, including customizable compliance rules.

Embeddable Widget

Native API

Revenue Model For Distributors

Integrate an Existing Vault

Fee-sharing agreement

with the curator

Deploy & Own a Vault

Set a performance fee based

on interest generated

Custom implementations with end-to-end support

Tailored Risk

Offer curated vaults from conservative to aggressive for different users.

Reward Management

Bespoke rewards management to attract and retain users.

Compliance

Configurable to fit within existing compliance frameworks

Revenue Share

Earn a share of performance fees from capital you direct to vaults.

Everything you need from your yield infrastructure

Sustainable yield

Highly competitive rates driven by global borrowing demand.

Customizable

Use existing vaults or deploy new vaults with bespoke risk

profiles and compliance.

Noncustodial

Users maintain complete ownership of their assets and positions.

Trust through transparency

All yields, allocations, risks, and fund flows are verifiable onchain.